maine tax rates by town

This map shows effective 2013 property tax rates for 488 Maine cities and towns. At the median rate the tax bill on a.

Maine Loses People And Their Income To States With No Personal Income Tax Maine Policy Institute

The statewide median rate is 1430 for every 1000 of assessed value.

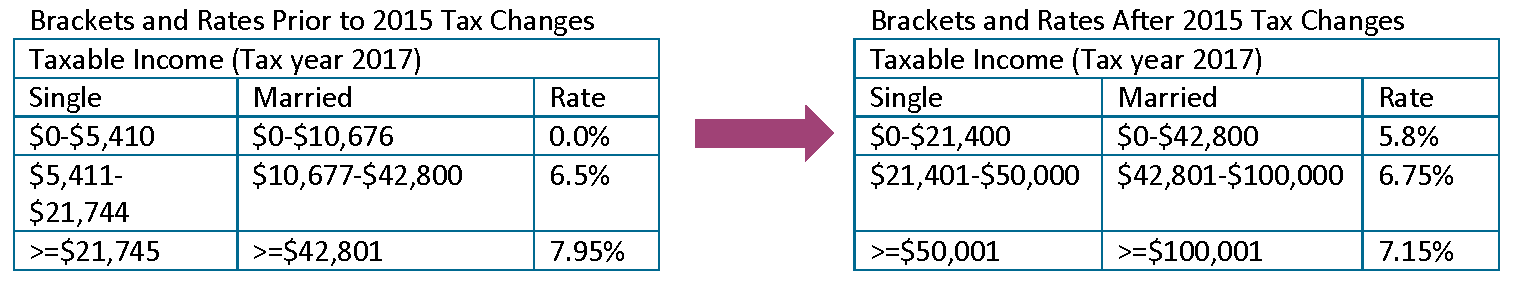

. Each year prior to February 1st Maine Revenue Services must certify to the Secretary of State the full equalized value of all real and personal property which is subject to taxation under the laws. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent. This is the total of state county and city sales tax rates.

The 55 sales tax rate in Old Town consists of 55 Maine state sales tax. Please contact our office at 207-624-5600 for. Maine also has a corporate income tax that ranges from 350 percent to 893 percent.

Auburn ME Sales Tax Rate. Maine Property Tax Rates by Town The Master List mainerco Are you looking to move somewhere in Maine but want to estimate how much youd pay in property taxes. Maine is ranked number twenty out of the fifty.

A mill is the tax per thousand dollars in assessed value. Lowest sales tax 55 Highest sales tax 55. The Town sends out one Tax Bill per year it is addressed to the owner of the property as of April 1 2022.

The maximum rate of interest that can be charged per Title 36 MRSA. There is no applicable county tax city tax or special tax. The minimum combined 2022 sales tax rate for Old Town Maine is.

City Sales Tax Rate Tax Jurisdiction. The Maine sales tax rate is currently. This unit is responsible for providing technical support to municipal assessors taxpayers legislators and other governmental agencies.

The Maine income tax has three tax brackets with a maximum marginal income tax of 715 as of 2022. 400 up to 600. Bangor ME Sales.

Pursuant to State Law the Town does not pro rate taxes. Augusta ME Sales Tax Rate. 2022 Taxes were committed on September 17th with payment due on November 17th.

Tax amount varies by county. 499 rows CityTown County 2017 Rate 2010 Rate Growth since 2010. 4 to lower the towns tax rate slightly 27 cents to 2218 per 1000 of assessed value.

2022 List of Maine Local Sales Tax Rates. Detailed Maine state income tax rates and brackets are available on this page. The Town of Palermo operates on a calendar year from January to December.

Municipal Services and the Unorganized Territory. Section 5054 is as follows. The Property Tax Division is divided into two units.

Our division is responsible for the determination of the annual equalized full value. The County sales tax. 8 hours agoRUMFORD The Board of Selectmen voted Oct.

The median property tax in Maine is 109 of a propertys assesed fair market value as property tax per year. The sales tax jurisdiction name is Maine which may refer to. 27 rows In 1997 44 of the total revenue raised by the states three major tax systems was.

Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466 EASTON 1595 1685 1754 1726 1737 1739 1521. For example a home with an assessed value of. The rates that appear on tax bills in Maine are generally denominated in millage rates.

Maine Property Tax Rates By Town The Master List

How Do Marijuana Taxes Work Tax Policy Center

Local Maine Property Tax Rates Maine Relocation Services

Maine Property Tax Rates By Town The Master List

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Map How High Is Your Town S Property Tax Rate Press Herald

2022 Property Taxes By State Report Propertyshark

Governor Paul Lepage Calls For Elimination Of Maine S Income Tax Americans For Tax Reform

Current Tax Rate Town Of Buxton Me

How Do State And Local Property Taxes Work Tax Policy Center

Tax Maps And Valuation Listings Maine Revenue Services

Please Call Your Legislators Today And Urge Them To Oppose Bills To Increase Individual Or Corporate Income Tax Rates In Maine Maine State Chamber Of Commerce

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Kittery Maine Residents Will See Modest Tax Rate Increase

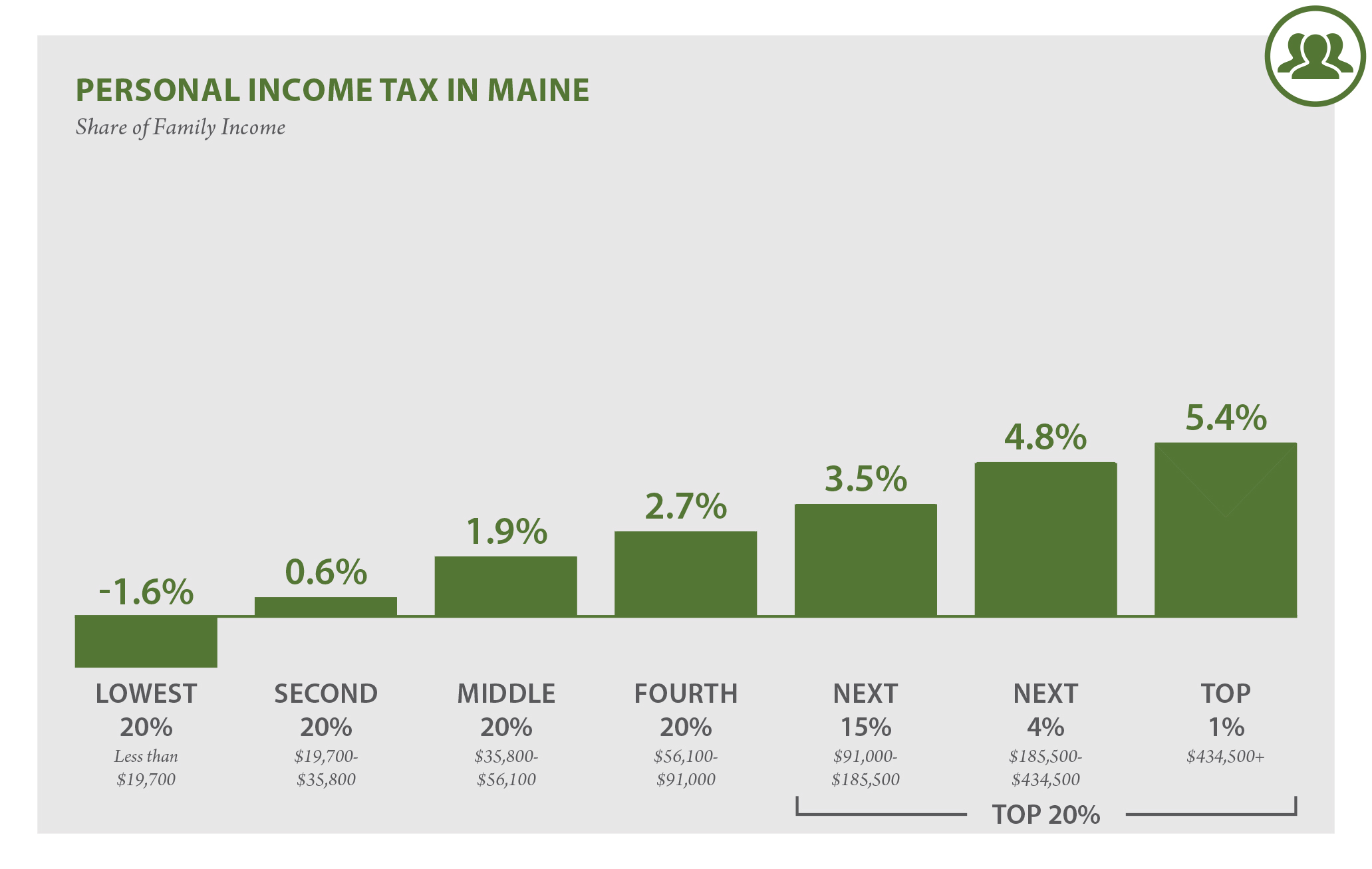

Maine Who Pays 6th Edition Itep